Business

Two Trends Shaping Production Planning Software Solutions

Some business leaders looked to technology to help with the burden and looked to production planning software to boost future proof production.

The COVID-19 pandemic showed how fragile the global supply chain could be. For many small manufacturers, downtime resulted in lost earnings and increased pressure on the business to keep the doors open and retain employees. This was not often the case, and many had to downsize.

Some business leaders looked to technology to help with the burden and looked to production planning software to boost future-proof production. Such software is not a silver bullet, but it can be an asset during uncertain times. Further, with two trends developing in the market, the asset’s value is now set to increase.

1. Machine Learning

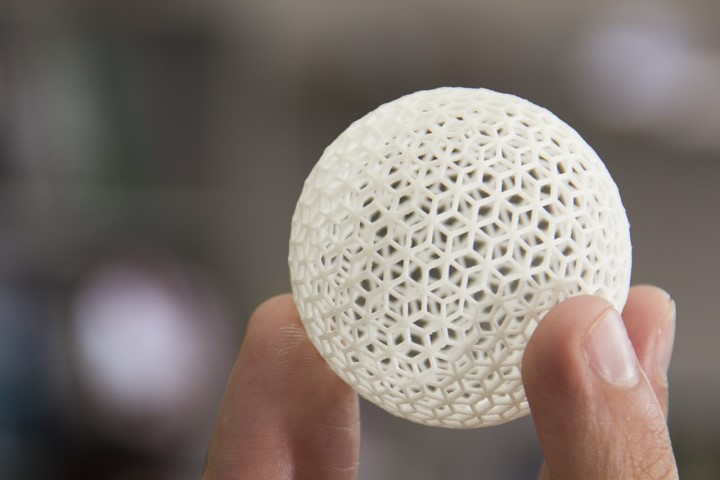

While machine learning is often portrayed as a holy grail for many industries, those within production planning have cautiously approached its adoption. This is mainly due to its posing a tough problem-solving in production planning than in other manufacturing environments. This is due in part to the number of variables generated from different sources production planning software needs to factor in.

Despite the difficulty, solutions can be found, and the central concept of machine learning, namely continuous improvement can be realized. Currently, the software can collect, analyze, and visualize data generated from multiple sources allowing for machine learning to take place.

Questions regarding the return on investment still will need to be asked by smaller manufacturers. However, solutions are available that target smaller enterprises. These solutions can provide high-fidelity insights into operations that are easily overlooked or not considered at all.

Production planning may lag behind other industries’ adoption of machine learning technology, but that does not mean it is not coming. While integration may be slower, it is breaking new ground for not only production planning but also machine learning. It is taking on even more complex systems than originally realized.

2. Continuous Planning and Execution

The recent pandemic showed that plans needed to be flexible to overcome hurdles global events can place in front of organizations. One way to remain flexible and prevent crashing into barriers is by adopting continuous planning and execution methodologies.

The idea can fill a textbook, but in providing an oversimplification of the concept, plans are treated as living objects rather than stages set in stone. The program can respond to events and sudden changes, whether determined by the manufacturer or a global phenomenon.

Providing an example of this flexibility helps to consider a typical manufacturer’s 30-day plan. Traditional planning methods rely on forecasts made by the designated team, which have to take into account the demand for manufactured goods and the costs involved.

What if suppliers are not able to deliver as promised? Or bringing the product to market is delayed by some unforeseen consequence? As continuous planning produces actionable plans more frequently, it allows for more rapid adoption of policies and execution, avoiding pitfalls, as there may be multiple plans spanning time frames of as little as a week.

3. Conclusion

Production planning has always been a complex affair. Current software solutions can make this difficult task easier. With the adoption of the trends mentioned above, that task is set to become even easier.

-

Instagram4 years ago

Instagram4 years agoBuy IG likes and buy organic Instagram followers: where to buy them and how?

-

Instagram4 years ago

Instagram4 years ago100% Genuine Instagram Followers & Likes with Guaranteed Tool

-

Business5 years ago

Business5 years ago7 Must Have Digital Marketing Tools For Your Small Businesses

-

Instagram4 years ago

Instagram4 years agoInstagram Followers And Likes – Online Social Media Platform