Business

Reduce Your Financial Risk by Diversifying Your Investment Portfolio

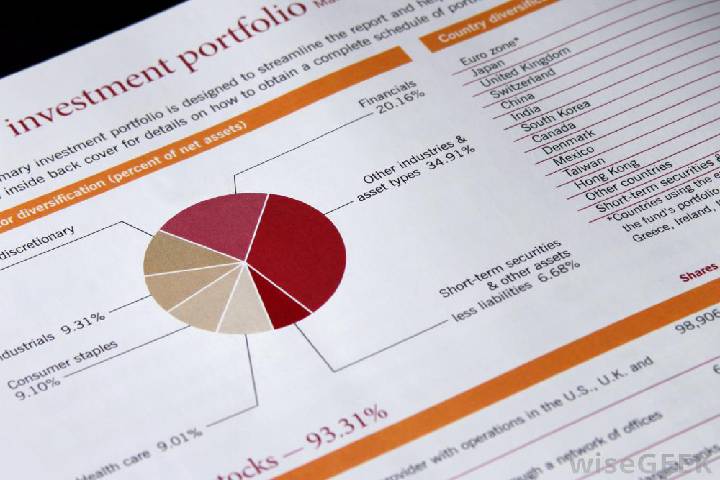

Reduce Your Financial Risk by Diversifying Your Investment portfolio. It always includes different types of financial instruments in various industries.

The most significant reason to strive for investment diversification is to minimize risks in financial markets. When you spread capital by investing in different securities, you will have more options available. Also, in the long run, such a practice will reduce your portfolio volatility over time.

A diversified portfolio always includes different types of financial instruments in various industries. Hence, it doesn’t guarantee protection against risks, but it lowers the chances drastically. In this article, we will show you seven great options for creating a diversified portfolio.

Table of Contents

1. Bonds

Since bonds provide regular interest income, they represent a vital ingredient of a diversified portfolio for income-focused investors. Bond investors receive payments based on the interest rate when the bond is sold. Also, bonds usually act as a cushion against all those difficulties, which often attack the markets.

As an investor, you can either focus on safety or growth. If safety and lower long-term returns are your options, then high-quality bonds should be the way to go.

2. Domestic stocks

Stocks are one of the most significant segments of a diverse portfolio, mostly because they provide too many excellent opportunities for higher growth in the long run. However, domestic stocks are often more volatile than other similar investing options.

That is the main reason why short-term investors reduce their involvement in stocks. Volatility is usually a good thing, but in this particular case, it might also work against you, when times of downturn happen. Therefore, be careful and understand your situation and investing goals.

3. Precious metals

Investing in precious metals such as gold, silver, platinum and palladium will, for sure, provide you with a guaranteed profit over a long period of time. If you want to maximize your return on investment, then Gmrgold.com could be a great option, You should time your purchase correctly as well.

However, even if you purchase when the prices are high, you should end up with a substantial profit nonetheless. There are several reasons why people consider precious metals as a secure investment, and the main reason is scarcity. Each of those precious metals provides high value since they are used in many industries.

4. Asset allocation

For good portfolio diversification, you need to spread the risk and your exposure to unrelated financial instruments. Therefore, you should not invest only in stocks. Instead, always strive for varying assets such as ETFs, REITs, and commodities. It will allow you to navigate economic cycles which affect securities at different times. Most investors prefer domestic equities and debt, but that should not be the case because of the massive array of assets.

5. Short-term investments

These conservative investments include money market funds, and their purpose is to offer stability and easy access to money. Also, short-term investments are quite safe, and they are ideal for those investors who don’t want a lot of risks involved.

However, since they are ideal for preserving capital, they will provide lower returns than bond funds in the end. Again, the decision about this form of investment is entirely up to you and your affinities, whether you prefer safety or long-term growth.

6. Private equity

Private equity involves a whole investment spectrum of private capital markets. Many private equity companies use multiple investment strategies. They typically raise funds and take capital from investors (institutional and non-institutional).

Those funds are then used to place investments in private companies. Afterwards, the money will be returned to investors after the firm pays the management and performance fee. It is a great investment idea for those who plan long-term growth.

7. Venture capital

Venture capital is a subset of private equity. Its speciality is investing in early-stage to growth-stage firms. At first, companies will specialize in early-stage investing. They will raise funds from institutional capital and deploy them to smaller companies.

This source of money is essential for startups and early-stage companies which have no access to public financing. Also, those startups usually lack revenue and operational history. Therefore, venture capital is risky, but it can produce huge returns.

Before you choose any of these options, consider your current financial position, goals, and priorities. Some of these options are safer, and some require more risk. Keep it in mind when you start building your diversified portfolio.

-

Instagram4 years ago

Instagram4 years agoBuy IG likes and buy organic Instagram followers: where to buy them and how?

-

Instagram4 years ago

Instagram4 years ago100% Genuine Instagram Followers & Likes with Guaranteed Tool

-

Business5 years ago

Business5 years ago7 Must Have Digital Marketing Tools For Your Small Businesses

-

Instagram4 years ago

Instagram4 years agoInstagram Followers And Likes – Online Social Media Platform